Investing in technology necessitates extensive research, particularly when the technology is new, to determine whether it is the best option and timing. Technology investments could take the form of financing from angel investors, companies, venture capitalists, the government, or other institutions through grants. Prior to investing in a new technology or product, consider its technological, economic, and business viability, followed by a risk assessment, patent valuation, and due diligence. Furthermore, patent data allows you to anticipate technology trends and disruptive innovations. As a result, combining patent information with market data allows for more informed research and investment decisions.

Validation of Technology

Before investing in a new technology space, make sure you’re investing in the right one. Examining patenting trends, calculating the value of existing patents, and researching competitors’ technological strengths will provide you with an idea of the current landscape.

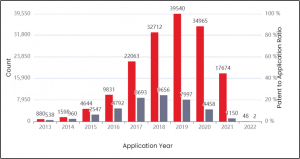

- Patent Trend Analysis: A statistical analysis of the patent publication rate in a specific field or company gives information regarding technology maturity and existing R&D investments in that field or company. This helps determine whether the technology is ready for further investment. You can also use this to keep up with overall technology trends in the space

This graph depicts the number of applications filed and the number of grants made as a result of these applications. The grant rate is a good indicator for identifying successful applications and helps to understand technological progress.

- Market Interest: Patents can help you identify the key competitors in the technology you’re researching. Validating the competition’s interest levels, such as their level of aggression in fresh patent filings, gives a clear indication of the technology’s market potential

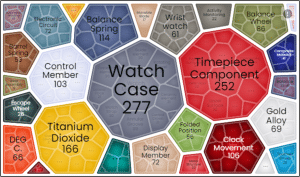

- Technology Breakdown: Visualization of the major concepts of the technology domain. This aids in understanding the most commonly used concepts as well as the key focus areas in the technology space

Risk Evaluation and Competitor Analysis

Another step in validation is to analyze competitors’ existing IP and determine if they pose a threat to the proposed transaction. Early warning signs will be provided by a risk assessment (if any). This validation is carried out using the techniques listed below.

- Identification of Competitors: Conduct a proper patent search of that particular technology space to determine the number and quality of competitive IP owned by other companies. Evaluate their recently granted or published patents to comprehend if the protected technologies pose a roadblock or any other type of competitive risk to the technology you are engaged in. Investigate competitors’ global interests by searching for patent applications filed in multiple jurisdictions based on patent families

- Forward Citation Analysis: Forward citations aid in the prediction of the progression and impact of emerging technologies. One disadvantage is that if the technology is very new, this data may not be available

- Legal Risk Assessment: This entails determining whether the patent strategy was well thought out, conducting a freedom-to-operate analysis for the potential go-to-market product, and identifying NPEs (if any) that may pose a threat to business

As a result, using business intelligence data provided by patents, you can project competitors’ strategies. This can help you develop your own technology strategies to tackle them.

Technology Asset Valuation

The valuation of intellectual property assets is an important factor in determining the quantum and value of technology investments. The price point for the proposed investment is determined by an IP valuation process for the existing set of intellectual property.

Cost-based valuation (estimates of costs for innovative ideation, patent filing, and maintenance costs), market-based valuation (patent portfolio comparison with competing companies based on technology, portfolio size, and quality), and income-based valuation (calculations of patent portfolio income during a certain time period) are the three types of IP valuation.

Following the completion of the technology validation, risk analysis, and valuation tasks, you should conduct legal and financial due diligence to mitigate any remaining investment risks.

Summary

In a nutshell, a variety of factors such as consumer perception, technology popularity, and future market trends all have an impact on your investments. Nonetheless, thorough IP analysis and research can reduce the risk of tough decisions concerning technology investments in any R&D-driven business.